You should have access to a digital insurance card and keep a paper copy as a backup in case you forget. They are the providers of the report and they are the only company that discloses that report.

Buy Or Renew Car Insurance Policies Online Buy Car Insurance Policy In Easy Steps Get 24x7 Spot Assistanc Car Insurance Car Insurance Tips Best Car Insurance

Accidents Generally Stay on Insurance for 3 to 5 Years.

. You must keep both a digital copy on your phone a printed one in your car. You can even save a scanned copy of this. If your policy is currently still in effect this is a document that you probably want to have handy.

For car insurance you MUST keep the. Documents you should keep are. Look at your car insurance policy and see when the effective period truly is.

Other insurance policies such as those for your car or home should be kept at least as long as the policy is in force so you can reference its terms conditions and exclusions in the event of a claim. Premiums may go up and stay at a higher rate for at least a few years after the accident but it can vary by insurance company. The IRS may go back 6 years to audit your tax returns for errors or incorrectly claimed deductions so its important that you keep all tax-related documents for that length of time including.

Published On Dec 10 2021 1000 AM By InsuranceDekho. If you have been seriously injured or lost a loved one in an personal injury or workers compensation accident in Miami or Fort Lauderdale and have questions or concerns about your legal rights and responsibilities you should contact the personal injury and workers compensation attorneys at Payer Associates today by calling. Skip to content 888 412-1989.

As services become increasingly more available online you may find that keeping your documents digitally makes it easier to sort through and categorize. How Long You Should Keep Car Insurance Records and Why. Purchase and sale records.

Additionally if you sell your car. After it is removed the claim does. In case FIR is registered for accident-related claims you may retain a copy of it for future reference.

If you use your vehicle for business you might be able to write off your premiums when you file taxes. In most cases your surcharge will only bump your rates up if you have an at-fault loss or multiple non-fault losses. In case of an accident youll need this card as it has your registration number your insurance policy number other significant information.

Scanning documents and digitizing them can save you time space and a potential mess to. Instead the information is transferred to a third-party database. Generally speaking accidents may stay on your record for three to five years.

Until the claim is settled and you are paid as per the terms and conditions of the policy. 29 June 2010 at 123PM. Here are a few examples of how long some major cities keep accidents on driving records.

New York City NY - 3 additional years after the accident or conviction. It is important to have automobile insurance and it is your job to maintain track of your insurance records. 01 Car Insurance Card.

Records Retention Guideline 3. This card should be kept with you when operating your car. Here is a list of car insurance documents and how long to keep insurance policies.

The amount of time you should keep different documents will vary depending on the document but you will not need to keep your policy documents for over a year. An at-fault claim thats on your record is considered chargeable for up to three years after the claim is closed. Chicago IL - 7 years to life depending on the situation.

Personnel and payroll records. Tail coverage periods are generally not longer than six years. If you have written off any insurance expenses then you should keep those documents for 3 to 7 years along with your tax file.

For example if the car insurance company only looks back three years you should be able to decrease your premium when the infractions fall off of your record and your policy is ready to be renewed. Houston TX - 3 years after the accident. They simply do not have the space to keep all of the information in their own files for a significant amount of time.

How Long Should You Keep Car Insurance Records. Los Angeles CA - 3 years from the date of the accident. There are a number of documents that you should save and keep for a longer time.

If none of the above circumstances apply to you then you are most likely safe to shred any old documents once you. You can contact ChoicePoint Services at 1-800-456-6004 for assistance on obtaining your CLUE report. I would keep statements for a few years as you might need something for a warranty dispute.

Keep tax records for 6 years. You can throw away old car insurance documents every time you switch providers but you should keep car insurance documents until any claims are settled and youve been paid. Take notice of how long you should preserve your auto insurance records after reading this article.

You should get a new set of policy documents yearly sometimes even more often. Any tax records related to your vehicle should be kept for seven years after filing the tax return. Even if you do cause an accident it will not remain on your insurance forever.

Insurance companies often allow you to make a claim retroactively within a certain time period so retain the policy for another two to seven. Call Personal Injury Attorney Jared Everton at. Therefore if you do not want to worry about figuring out the length of the tail coverage a.

Generally speaking the information here will be stored for up to seven years or until the claim can no longer be disputed. Hence you must keep this card in your car all the time. Companies will keep your claims records stored in a database that other companies have access to for seven years.

Once you get those documents you wont need your old ones anymore. You may retain claim-related paperwork for a few years just in case. You definitely want to keep an insurance document around for at least the time in which your policy is going to be in force.

For most financial matters anything more than 6 years old is barred by statute.

7 Things You Must Know About Car Insurance In Dubai Car Insurance Insurance Liability Insurance

How Long Do I Need To Keep Car Insurance Policies Insurance Policy Car Insurance Car Insurance Rates

Do You Think You Know All About Insurance Car Care Tips Car Care Fun Facts

Find Out Which Types Of Car Insurance You Should Be Looking Into For Your Coverage Needs We Have Compiled Auto Insurance Quotes Car Insurance Insurance Quotes

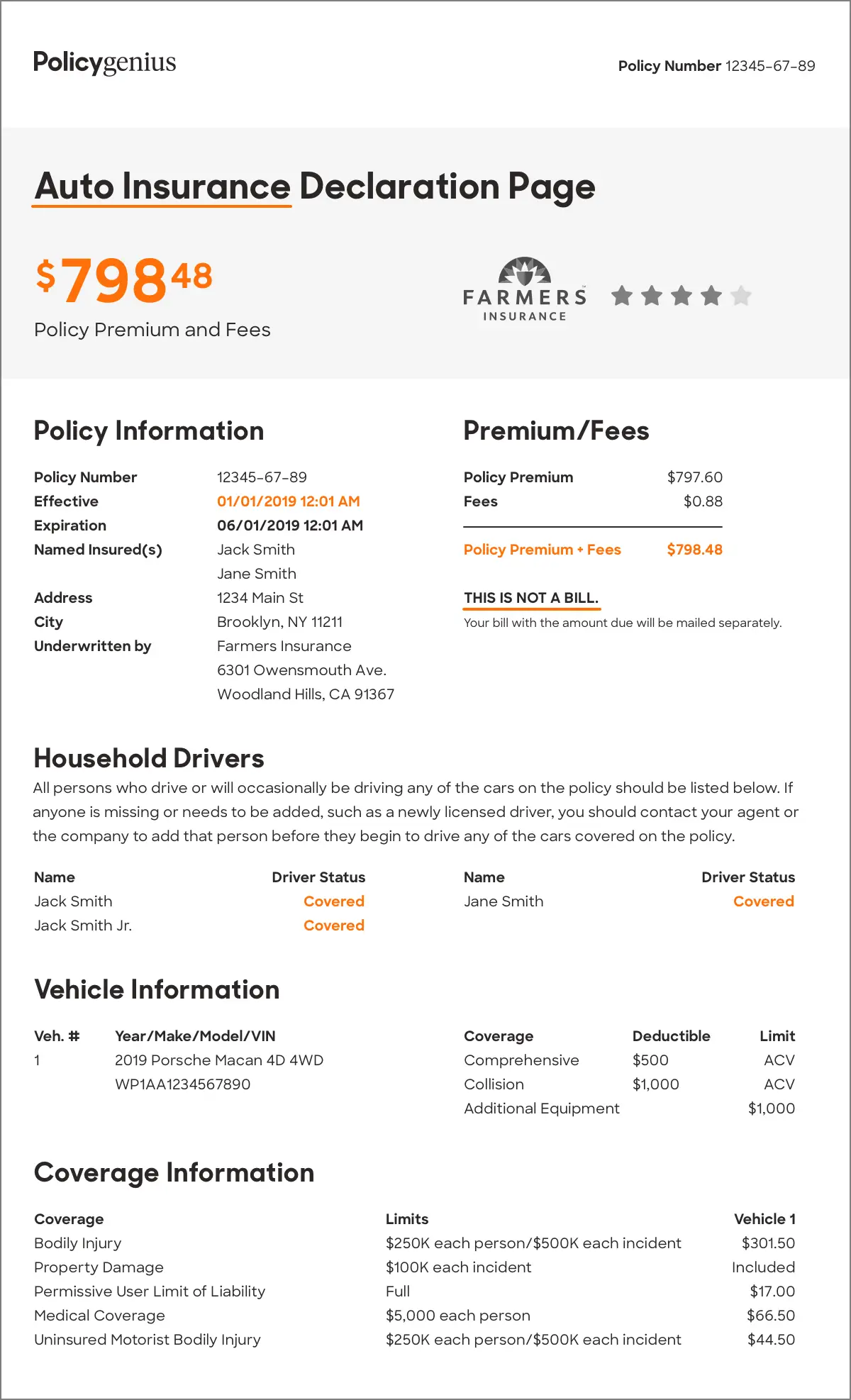

Understanding Your Car Insurance Declarations Page Policygenius

0 comments

Post a Comment